Are you a homeowner in Charlotte, NC, facing financial problems and considering selling? Understanding the concept of a short sale is relevant in such circumstances.

A short sale sells your property for less than the remaining mortgage balance. This is often pursued by homeowners in financial troubles to avoid foreclosure.

This guide provides information about short sales in Charlotte, NC. Topics include the eligibility criteria for a short sale and the process involved.

What is a Short Sale in Charlotte NC?

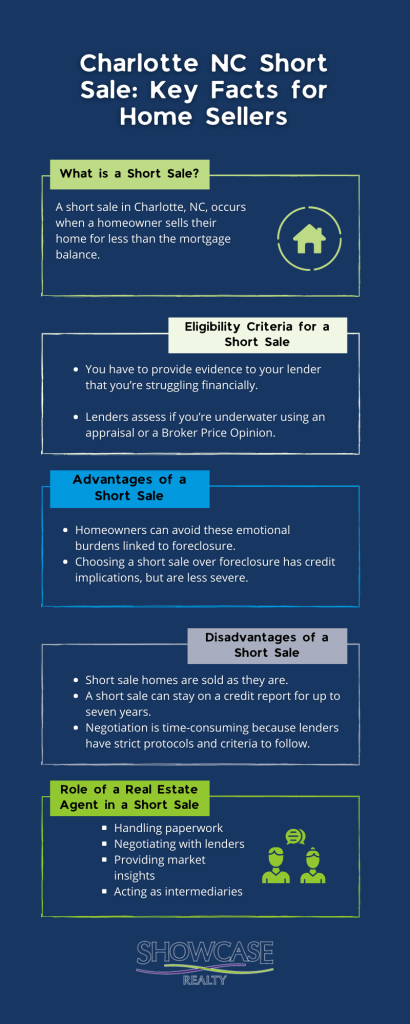

A short sale in Charlotte, NC, occurs when a homeowner sells their home for less than the mortgage balance. This situation happens when the homeowner is having financial difficulties and can’t afford to pay the mortgage anymore.

Homeowners consider short sales financial hardship caused by job loss, medical expenses, or divorce. It’s a way to sell their home before the bank takes it away in foreclosure.

Another situation leading to a short sale is when the home’s value falls below the mortgage amount. This is called an upside-down mortgage. A short sale is better than defaulting on mortgage payments in such cases.

But making a short sale is complex. The homeowner needs approval from their mortgage lender because they agree to accept less than the owed amount.

This process is time-consuming. It involves negotiations between the homeowner, their real estate agent, and the lender.

How Long Does a Short Sale Take in Charlotte NC?

The timeline for completing a short sale varies based on several factors.

- Lender approval process

One factor influencing the duration of a short sale is the lender’s approval process. After a buyer makes an offer, the lender reviews it and decides whether to accept it. This process can take a few weeks to months, depending on the lender’s workload and requirements.

- Document preparation and submission

Before submitting the offer, the seller and their agent gather documents, including financial records and hardship letters.

Any delays in getting these documents ready can prolong the processing time.

- Negotiations

The seller, buyer, and lender discuss the price, closing costs, and terms, which can extend the timeline.

- Buyer’s financing

The buyer also has tasks to do, such as getting financing. If these steps are delayed, it makes the process even longer.

- Market conditions

Real estate market changes affect the timeline of a short sale.

What are the Eligibility Criteria for a Short Sale in Charlotte NC?

- Proving financial hardship

Financial hardship can result from job loss, medical expenses, divorce, death of a spouse, or prolonged unemployment. These events can impact your ability to meet mortgage payments.

You have to provide evidence to your lender that you’re struggling financially. You submit documents like termination letters, medical bills, or other relevant financial records. The more detailed your documentation is, the stronger your chances of getting approved.

- If jobless, you must provide termination notices or proof of job search efforts.

- High medical costs count as financial hardship. You can prove with medical invoices, insurance statements, or ongoing treatment records.

Lenders approve short sale requests when they see strong evidence of financial struggles.

- Being “underwater” on your mortgage

Being underwater occurs when your mortgage balance exceeds your home’s market value. Lenders assess if you’re underwater using an appraisal or a Broker Price Opinion.

Working with real estate experts in Charlotte is invaluable. We validate your underwater status and liaise with your lender to increase your chances of approval.

Click here to learn about the benefits of working with a short sale expert in Charlotte NC.

The Short Sale Process in Charlotte NC

- Consider loan modification first

Homeowners should discuss loan modifications with their bank before choosing a short sale. This includes negotiating a lower interest rate or adjusting payment plans.

- Seek expert advice

Homeowners should consult lawyers, tax professionals, and real estate agents. While costly, their expertise can prevent bigger financial problems in the long run.

- Gather documents and find a buyer

Homeowners must gather documents showing their need for a reduced-price home sale. These include bank statements, tax records, and a hardship letter. At the same time, find a buyer interested in a short sale purchase.

- Submit an offer to the bank

Submit the buyer’s offer and the short sale proposal to the bank or lender. This proposal outlines the sale price, terms, and reasons for the short sale.

- The bank reviews and decides

The lender reviews the offer and the short sale proposal. They verify if the sale price aligns with the property’s market value and mortgage balance.

- Finalize the sale

If approved by the bank, the short sale process closes. All parties collaborate to finalize the sale, signing legal papers and transferring ownership.

Roles of Different Parties:

- Homeowner: Initiates the short sale process, provides documentation, and works with experts.

- Real estate agent: Assists in listing the property, identifies potential buyers, and negotiates with the lender.

- Bank or lender: Reviews the short sale proposal, assesses finances, and approves or disappoves the sale.

- Buyer: Makes an offer and works with their agent to complete the purchase.

What are the Advantages of a Short Sale?

- Avoiding Foreclosure

Foreclosure occurs when the bank reclaims a home due to payment default. This process involves several stages, such as selling the house in a public auction and sending eviction notices to the homeowners. These steps can be emotionally taxing.

With a short sale, homeowners can avoid these emotional burdens linked to foreclosure.

- Mitigating credit damage

Foreclosure severely impacts your credit score, leading to long-term damage. Restoring your credit after a foreclosure takes several years.

Choosing a short sale over foreclosure has credit implications, but are less severe.

What are the Disadvantages of a Short Sale?

- Short sale homes are sold as they are. This means you will encounter structural problems and outdated systems (plumbing or electrical). Fixing these problems is expensive and should be included in your budget for buying the home.

Besides repair costs, you may encounter undisclosed expenses like legal fees, property taxes, or homeowner association dues.

Due to their existing condition, short-sale homes have lower resale value. This can affect your potential profits if you decide to sell later.

- A short sale affects a homeowner’s credit score.

The lender reports the short sale, indicating that the homeowner couldn’t pay their mortgage. This can lower the seller’s credit score.

A short sale can stay on a credit report for up to seven years. During this time, it is challenging for the seller to get new loans, such as purchasing a car or another home.

It’s not easy to recover from a significant credit score drop. Rebuilding creditworthiness requires careful money management, timely payments, and responsible financial behavior.

- Homeowners must negotiate with their mortgage lenders for a lower sale price. Negotiation is time-consuming because lenders have strict protocols and criteria to follow.

Lenders have specific guidelines for short sales, including document deadlines and property inspections. Sellers and buyers must follow these guidelines strictly.

Short sales also involve legal and financial details that are hard to understand. Sellers and buyers should consult with agents, lawyers or financial advisors to understand the risks during the short sale process.

Want to avoid common pitfalls when selecting a short sale agent in Charlotte NC? Check out article: https://shortsaleadvisors.us/9-mistakes-to-avoid-when-choosing-your-charlotte-nc-short-sale-agent/.

How Can a Real Estate Agent Assist Homeowners with a Short Sale?

A real estate agent aids Charlotte homeowners in short sales. Here’s how a real estate agent can assist with a short sale:

- An experienced agent like Nancy Braun, with the Certified Short Sale Seller designation, has specific training and knowledge about the short sale process.

- Short sales need extensive paperwork and negotiations with lenders. Competent agents assist with complex tasks and make sure all documents are submitted on time.

- Agents also negotiate with lenders on behalf of the homeowner. Our goal is to persuade the lender to accept a reduced sale price covering the mortgage balance.

- Agents are well-versed in the Charlotte housing market. We provide insights on pricing strategies, market trends, and property values for determining an appropriate short sale price.

- Agents act as intermediaries between the homeowners, lenders, and other parties.

- Going through a short sale is stressful for homeowners. However, having an experienced agent reduces this stress. We handle the details, answer questions, and provide support to make the process more manageable for homeowners.

For more detailed tips on finding short sales and locating short sale agents in Charlotte, NC, click here.

Feel free to get in touch if you need help with the short sale process. Contact me, Nancy Braun, at 704-997-3794 to schedule a consultation.

Explore comprehensive insights into Charlotte NC short sales with our expert guide: https://shortsaleadvisors.us/what-you-need-to-know-about-the-short-sale-process-in-charlotte-nc/